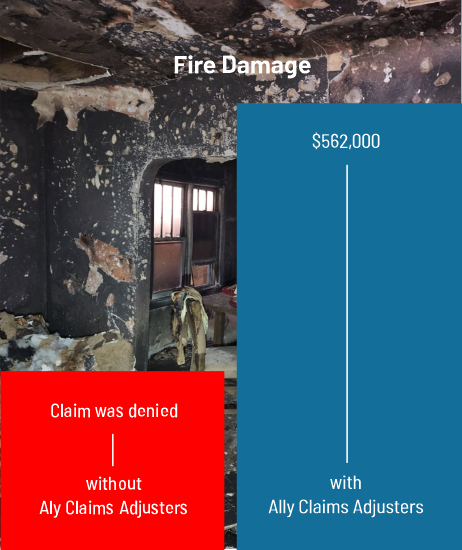

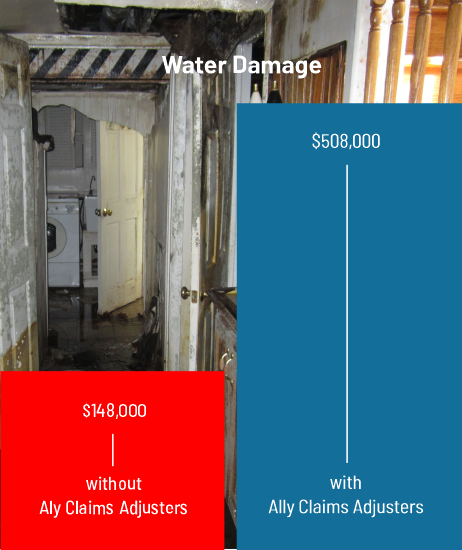

Don’t Get Shortchanged By Your Insurance Company

First and foremost, the insurance companies are not your friends. Insurance companies are armed with experienced adjusters, experts and lawyers committed to minimizing necessary repair costs and underpaying claims by taking advantage of a policyholder’s lack of experience and knowledge. Our team of public adjusters will level the playing field, steer you away from the pitfalls your insurance adjuster is counting on you to make and get you a higher payout.